User Roles

Each Corporate user will belong to a User Role. User Roles contain all the rights for the company's users. Corporate's default roles have different features, permissions, and Transaction Types.

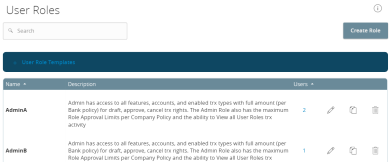

List of User Roles

Depending on your configuration, default User Role Templates may appear. Copy the templates of existing roles to create new User Roles. Contact your FI for more information on using role templates.

Note: Business users don't have access to User Roles. Only Corporate users have access to them.

Default User Roles include the following:

| Role | Description |

|---|---|

| Admin Role | The Admin (also known as Administrator) has access to all features, accounts, and enabled Transaction Types with maximum amounts allowed by your FI's policies for draft, approve, and cancel transaction rights. This role also has the maximum Approval Limits per Company Policy and the ability to view all User Role transaction activity. |

|

Payables Admin |

The Payables Admin has access to Company Policy related features, all accounts, and enabled payables Transaction Types (ACH Single Payment, ACH Payments, ACH Payroll, PassThru, Domestic Wire Transfer, and International Wire Transfer) with maximum amounts allowed by your FI's policies for draft, approve, and cancel transaction rights. The Payables Admin Role also has the maximum Approval Limits per Company Policy and the ability to view all User Role transaction activity. |

| Receivables Admin | The Receivables Admin has access to non-User or Company Policy related features, all accounts, and enabled receivables Transaction Types (ACH Single Receipt, ACH Collections, and PassThru) with maximum amounts allowed by your FI's policies for draft, approve, and cancel transaction rights. The Receivables Admin Role also has the maximum Approval Limits per Company Policy and the ability to view all User Role transaction activity. |

|

Payables/ Receivables Admin |

The Payables/Receivables Admin has access to non-User or Company Policy related features, all accounts, and enabled payables & receivables Transaction Types (ACH Single Payment, ACH Payments, ACH Payroll, PassThru, Domestic Wire Transfer, International Wire Transfer, ACH Single Receipt, and ACH Collections) with maximum amounts allowed by your FI's policies for draft, approve, and cancel transaction rights. The Payables/ Receivables Admin Role also has the maximum Approval Limits per Company Policy and the ability to view all User Role transaction activity. |

|

Payables Manager |

The Payables Manager has access to the Manage Recipients and Manage Subsidiaries features, all accounts, and enabled payables Transaction Types (ACH Single Payment, ACH Payments, ACH Payroll, PassThru, Domestic Wire Transfer, and International Wire Transfer) with 50% of maximum amounts allowed by your FI's policies for draft, approve, and cancel transaction rights. The Payables Manager Role also has 50% of the Role Approval Limits per Company Policy and the ability to view all User Role transaction activity. |

|

Receivables Manager |

The Receivables Manager has access to the Manage Recipients and Manage Subsidiaries features, all accounts, and enabled receivables Transaction Types (ACH Single Receipt, ACH Collections, and PassThru) with 50% of the maximum amounts allowed by your FI's policies per Company Policy for draft, approve, and cancel transaction rights. The Receivables Manager Role also has 50% of the Approval Limits per Company Policy and the ability to view all user and User Role transaction activity. |

|

Payables Clerk |

The Payables Clerk has no access to features, access to all accounts, and access to enabled payables Transaction Types (ACH Single Payment, ACH Payments, ACH Payroll, Pass Thru, Domestic Wire Transfer, and Intl Wire Transfer) with 25% of the allowed amount by your FI's policies for the draft restricted and cancel transaction rights. The Payables Clerk also has 25% of the Role Approval Limits per Company Policy and the ability to view only their own User Role transaction activity. |

|

Receivables Clerk |

The Receivables Clerk has no access to features, access to all accounts, and access to enabled payables Transaction Types (ACH Single Receipt, ACH Collections, and Pass Thru) with 25% of the allowed amount by your FI's polcies for the draft restricted and cancel transation rights. The Receivables Clerk also has 25% of the Role Approval Limits per Company Policy and the ability to view only their own User Role transaction activity. |

|

View Only |

The View Only role has no access to features, but has access to all accounts, and access to view all Transaction Types (ACH Single Receipt and ACH Collections). |

Role templates are created by the financial institution to reduce setup requirements by the customer. However, roles can be created manually. After selecting a User Role, you can make changes for each role's Transaction Type. Changes take effect the next time the user logs in. Depending on your FI's settings, these changes may need to be approved first.

This page includes the following tabs:

|

Tab |

Description |

|---|---|

| Overview |

Displays a list of Transaction Types. Each enabled type must have at least one action. Transaction details include:

|

| Features |

Displays a list of entitlements and third-party services enabled for the User Role. Examples include:

These features will vary depending on our financial institution's configuration. |

|

Accounts |

Displays a list of accounts and access rights. Access rights include:

|

See Creating a User Role for more information.