Company Policy

End users with Manage Company Policy rights can manage the Company Policy on behalf of the company. The Company Policy can be edited, but never deleted. Company administrators with Manage Company Policy rights can edit the Company Policy to configure Transaction Types and limits they want at a company level.

Company administrators use the Company Policy page to manage accounts, features, and Transaction Types at the company level. These changes may need to be approved or rejected, if dual action of non-financial transactions is enabled.

See Dual Action for non-financial transactions for more information.

Company Policy page

All User Roles must adhere to the Company Policy settings. The roles cannot override what is allowed at the company level.

|

Tab |

Description |

|---|---|

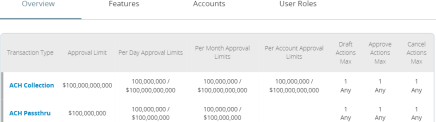

| Overview |

Displays a list of Transaction Types. Each enabled one must have at least one action. Transaction details include:

|

| Features |

Displays a list of entitlements and third-party services enabled for the company. Examples include:

These features will vary depending on our financial institution's configuration. |

|

Accounts |

Displays a list of accounts and access rights. Access rights include:

|

| User Roles | Displays a list of User Roles, descriptions, statuses, and users. |

For each Transaction Type, you can change the following features:

| Feature | Description |

|---|---|

| Allowed Actions |

Change the following information in an action:

After making the changes, a summary of the proposed action appears. Note: The financial institution may turn off the Subsidiaries, Draft Hours, IP Address, Location features, and SEC Codes. These features will vary depending on our financial institution's configuration. |

| Approval Limits |

View limits on the maximum transaction amounts. They include the following details:

View limits on the maximum number of transactions, also known as the maximum count. They include the following details:

These limits will be read-only in the Company Policy. |

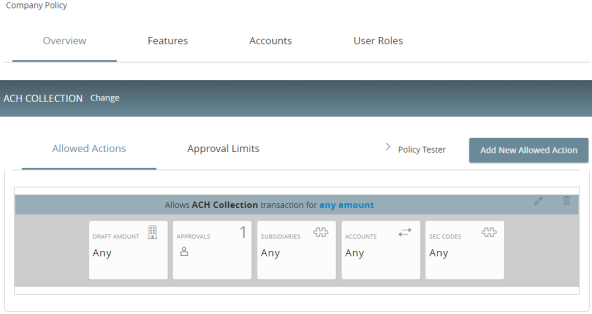

Company Policy Allowed Actions

Allowed Actions at a Company Policy Level determine how each Transaction Type is enabled. They also determine what criteria is required for this transaction to be drafted and approved.

Company Allowed Actions tab

Note: You can't configure accounts or subsidiaries in the Allowed Actions tab of an ACH PassThru Transaction Type.

Features in a Company Policy include:

| Features | Description |

|---|---|

| Draft Amount |

Maximum draft amount. |

| Approvals |

Control how many approvals are needed to complete a transaction. |

| Accounts |

Accounts available for the Transaction Type per the Allowed Action criteria. |

| Subsidiaries | Subsidiaries available for the Transaction Type per the Allowed Action criteria. |

| SEC Codes | Standard Entry Class Codes for the Transaction Type per the Allowed Action criteria. |

| Draft Hours |

Draft hours available for the Transaction Type per the Allowed Action criteria. |

| Location | Regions available for the Transaction Type per the Allowed Action criteria. |

| IP Addresses | IP addresses from which a transaction was performed. |

Note: The User Roles page has its own set of Allowed Actions which adheres to the same set of features configured by our financial institution.